- #China

- #China-US Competition

- #Economy & Trade

- #Global Issues

Key Takeaways:

- The Trump–Xi Busan summit produced strong optics but weak substance — a truce without trust.

- Most “agreements” remain provisional, leaving core disputes over technology, tariffs, and Taiwan unresolved.

- Busan may have paused escalation, but real progress will hinge on Trump’s April 2026 visit to Beijing — not photo ops.

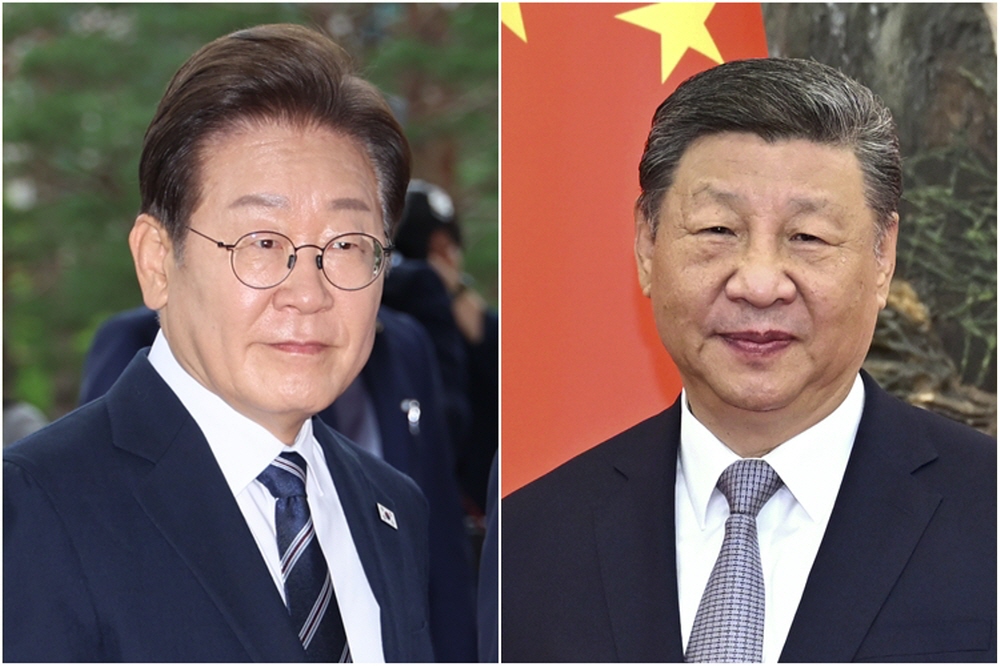

When U.S. President Donald Trump and Chinese President Xi Jinping met in Busan on October 30, it was billed as a breakthrough moment — a sign that the world’s two largest economies were finally ready to dial down tensions. The optics were undeniably strong: two powerful leaders shaking hands, smiling for the cameras, and declaring a “massive victory” for workers, farmers, and businesses.

But once the cameras stopped flashing, it became clear that the

Busan meeting was more performance than progress. The agreements reached were

largely provisional, familiar, and short on enforcement. For all the rhetoric

about breakthroughs, the meeting restored what Ryan Hass of Brookings described

as a “shallow truce with limited deliverables” — essentially a return to the

status quo ante.

This is not the first time Washington and Beijing have declared a

truce only to see it unravel months later. We have had the Geneva, London, and

Madrid rounds — each producing optimistic communiqués, each dissolving into

renewed friction. Busan, for all its fanfare, fits neatly into that pattern.

Talking is better than not talking, but good optics cannot substitute for real

substance.

What Was Agreed — and What Wasn’t

According to reports from China Briefing and Brookings,

the Busan meeting produced a modest package of reciprocal gestures designed to

calm markets and signal good faith. Both sides agreed to lower or suspend

certain tariffs, pause retaliatory port fees, and renew cooperation on fentanyl

controls. China reportedly promised to issue export licenses for rare earth

materials and to resume large-scale purchases of American soybeans. The United

States, in turn, suspended its new “50 percent ownership rule” on export

controls and scaled back tariffs related to fentanyl enforcement.

In theory, this represents a partial unwinding of the tit-for-tat

measures that have accumulated since early 2025. In practice, however, most of

these actions are temporary, conditional, or still awaiting confirmation from

Beijing. The Chinese Ministry of Commerce (MOFCOM) verified only some of the

steps the White House claimed in its Fact Sheet — particularly those relating

to tariffs and port fees — but remained silent on several of Trump’s key

announcements, including the sweeping “de facto removal” of rare earth export

controls.

Even on soybeans, one of Trump’s favorite metrics of trade

diplomacy, the numbers do not add up. The White House claimed that China had

agreed to purchase at least 12 million metric tons of U.S. soybeans this year

and 25 million annually through 2028. Yet China’s official readout only

mentioned an agreement to “expand agricultural trade.” As one analyst put it,

this is more a handshake on intentions than a signed contract.

Brookings’ Patricia Kim summarized it well: the meeting “did little

more than pause escalation in a trade conflict,” amounting to “a fragile

ceasefire rather than genuine progress.”

The Illusion of Progress

The Busan meeting worked well as political theater. Both Trump and

Xi left the summit able to claim victory before domestic audiences. Trump could

present himself as the master negotiator who lowered tariffs and extracted

concessions from Beijing. Xi could show Chinese citizens that he had defended

national interests, blunted U.S. pressure, and stabilized relations on

Beijing’s terms.

But beneath the surface, the meeting reflected a deeper dynamic:

both sides are using these truces as breathing space, not as steps toward

reconciliation. Brookings’ Jonathan Czin called it “friction without

competition” — plenty of commotion, little coordination. Beijing has learned to

push back against U.S. economic measures, using rare earths and export controls

as leverage. Washington, meanwhile, continues to experiment with tariffs and

technology restrictions, often more for domestic signalling than for long-term

strategic planning.

For Xi, a pause in confrontation buys time to strengthen China’s

self-reliance in high technology, critical materials, and advanced

manufacturing — goals clearly outlined in China’s latest Five-Year Plan. For

Trump, the optics of de-escalation are politically convenient ahead of the 2026

midterms. As Czin noted, Beijing likely recognizes that Trump “will be loath to

see one of his signature deals unravel just before voters go to the polls,”

which only increases China’s leverage over the U.S.

Both leaders thus benefit from declaring peace, but neither seems

prepared to make the structural concessions that real peace would require.

That’s why the deal feels familiar: it freezes the fight without resolving it.

Strategic Competition Remains the Real Story

Zooming out, the Busan meeting did nothing to alter the underlying

trajectory of U.S.-China relations. As Brookings’ Mira Rapp-Hooper put it, “the

thorniest issues in the U.S.-China relationship were either not addressed or

were not acknowledged publicly.” Those issues include technology access,

industrial subsidies, intellectual property, and, of course, Taiwan. Trump

reportedly said the Taiwan issue “did not come up” — a remarkable omission that

underscores how shallow the discussions truly were.

The reality is that U.S.-China strategic competition is here to

stay. The economic gestures agreed upon in Busan may ease tensions for a few

months, but they do not address the structural decoupling underway in supply

chains, technology, and finance. The United States continues to push

“friend-shoring” of key industries and critical minerals. China continues to

cultivate influence across the Global South and to position itself as a

champion of multilateralism — even as it doubles down on domestic industrial

dominance.

For the Asia-Pacific region, this uneasy truce brings both relief

and uncertainty. It lowers the temperature, but it also highlights the

volatility of great-power relations. Middle powers such as South Korea and

Japan are once again spectators to a cycle of confrontation and conciliation

over which they have limited control.

As Patricia Kim observed, “these are two economic juggernauts

preoccupied with their own advancement, while smaller economies scramble to

avoid collateral damage.” For Seoul, this is a sobering reminder that hedging —

maintaining flexibility and autonomy amid U.S.-China rivalry — remains the only

realistic strategy. The Busan meeting may have taken place on Korean soil, but

it was not about Korea. It was about the choreography of great-power

competition.

A Pause, Not Progress

The best that can be said of the Busan summit is that it created

space for dialogue. Talking, even superficially, is better than silence. The

suspension of new tariffs and export controls will give businesses temporary

relief. The reopening of agricultural trade channels may help American farmers

and stabilize prices. The rare earth reprieve offers breathing room to global

manufacturers.

But these are all tactical gains, not strategic shifts. None of the

underlying disputes — from semiconductor restrictions to data localization to

maritime competition — have been resolved. Even the much-publicized cooperation

on fentanyl remains vague, with no enforcement mechanism or timeline.

The structure of the deal itself ensures fragility: most provisions

expire within a year, right around the time of Trump’s planned April 2026 visit

to Beijing. That visit will be the true test of whether this current calm can

evolve into a more durable framework for U.S.-China relations. Until then, both

sides will likely claim progress while continuing to maneuver for advantage.

Waiting for April

In this sense, Busan was less a turning point than a holding

pattern. It bought time for both governments, reassured markets, and offered

each leader a brief political dividend. But it did not change the underlying

reality that U.S.-China rivalry remains the defining feature of the

21st-century international order.

“Announcing deals is easy,” Ryan Hass reminded us, “but negotiating

real deals that represent shared buy-in, common understandings, and hard

commitments is difficult.” The Busan meeting achieved the former, not the

latter.

For now, we should welcome the fact that Trump and Xi are talking,

but we should not confuse dialogue with détente. Until we see genuine

follow-through — verifiable implementation, structural reforms, and lasting

restraint — this truce will remain what it has always been: an intermission

between acts in an ongoing strategic drama.

So yes, the optics were good. The smiles were reassuring. The press

releases were upbeat. But the fundamentals haven’t changed. The United States

and China are still locked in competition over technology, trade, and power —

and neither side seems ready to rewrite that script.

Come April, when Trump travels to Beijing, we’ll find out whether

Busan was the prologue to something meaningful — or just another photo

opportunity on an increasingly crowded stage.

Until then, let’s not mistake movement for momentum. Good optics

can calm markets for a week; real progress requires consistency, credibility,

and political will — none of which were evident in Busan. For now, all we can

do is wait for April.

Alexander C. Tan is Professor of Political Science and International Relations at the University of Canterbury and Professorial Fellow and Founder of the Institute for Indo-Pacific Affairs in Christchurch, New Zealand.