Key Takeaways:

- Under Trump 2.0, tariffs have reshaped foreign direct investment into a tool of economic statecraft—where producing inside the U.S. or allied hubs has become a political act and proof of alignment.

- In semiconductors and shipbuilding, Japan’s FDI is evolving into alliance infrastructure: shared R&D ecosystems, modular co-production, and expanded MRO capacity that strengthen collective economic security.

- To make this system durable, the U.S. and Japan must institutionalize predictability through interoperable reviews, fast-track treatment for trusted investors, and a shared production perimeter built on political trust, not price.

I. Introduction — Tariffs, Alignment, and

the New Logic of Allied Investment

The second Trump administration has

redrawn the political economy of allied engagement with the United States. What

began as rhetoric has matured into a system of rule by tariff and negotiation

by exception, where access to the U.S. market depends on both localization and

political alignment. A new, often underestimated variable in corporate calculus

is episodic enforcement. The September 2025 immigration-and-labor raid at

Hyundai’s Georgia megasite—an operation that detained roughly 475 workers and

temporarily halted work[1][2]—showed how compliance shocks can

reprice projects overnight even for strategically aligned firms, and why

governance must be engineered into high-capex projects from the outset.

For Japan, the consequence is a structural

turn. Foreign direct investment (FDI) is no longer merely a vehicle for market

access—it has become a proof of strategic alignment. In a tariff-first world,

producing inside the United States (or within tightly coupled allied hubs) is

not just an economic decision; it is a political act. The two arenas where this

shift is most consequential—semiconductors and shipbuilding—map directly onto

allied economic security: cognitive capital and industrial muscle.

II. Semiconductors — Shared Innovation

Sovereignty

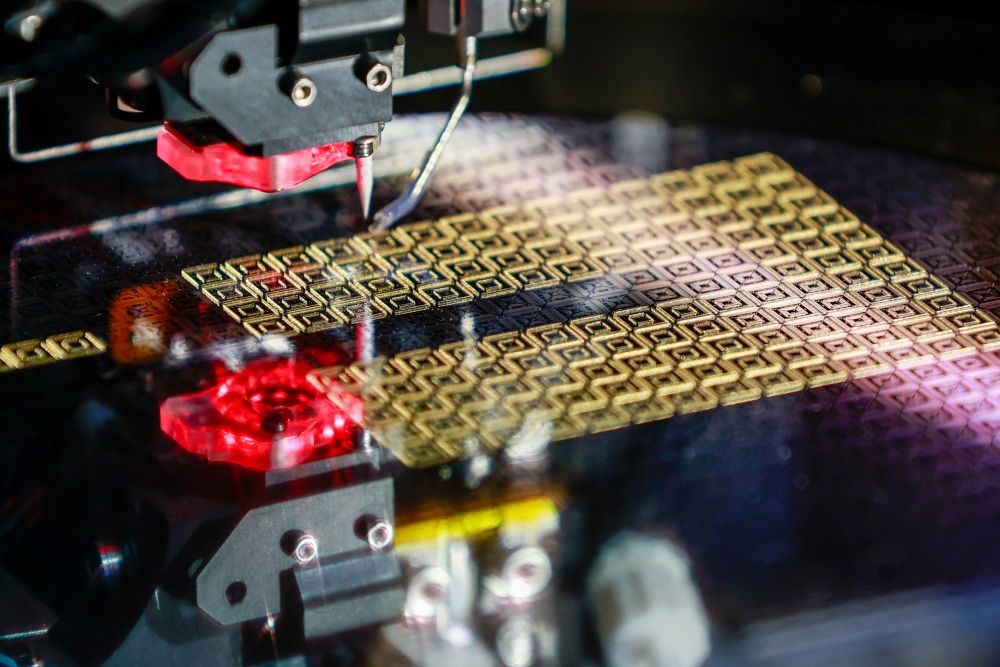

Semiconductors show how FDI has evolved

from commercial activity to alliance infrastructure. Washington treats

microelectronics as the backbone of national resilience, and Tokyo’s dominance

in upstream materials and equipment makes Japan indispensable to any trusted

chip ecosystem. Under the post-2024 policy regime, the CHIPS and Science Act

remains in force but is administered with performance-based

conditionality—subsidies linked to domestic employment and on-time milestones[3][4]—creating

an industrial geography from Arizona[5] to

Texas[6], Ohio[7],

and New York[8] that exerts a

gravitational pull on Japanese suppliers of resists, CMP materials, metrology,

deposition and etch systems.

The strategic frontier is research and

development. The Rapidus–IBM collaboration at the Albany NanoTech Complex[9] has emerged as a prototype of shared

innovation sovereignty: engineers rotate across borders; joint pilot lines[10] compress learning cycles; and

sensitive design and process data remain within allied legal boundaries. The

result is not a mere transfer of know-how but a bilateral knowledge

architecture—an intellectual commons bounded by trust and jurisdiction.

Execution, however, still hinges on

governance. Workforce shortages, visa bottlenecks, and stringent safety regimes

have slowed projects across the American Southwest; the Georgia raid

underscored why predictable HR, safety, and immigration compliance must be

built into projects ex ante if timelines and budgets are to hold.

III. Shipbuilding — From Maintenance to

Co-Production

If semiconductors are the alliance’s

neural network, shipbuilding is its muscle memory—the material side of economic

security. America’s maritime base has eroded to a fraction of its past

strength: U.S. shipyards now produce only a handful of commercial vessels

annually—about 0.2 percent[11] of

global output—while China’s yards deliver volumes more than two hundred times

larger[12], with obvious implications for

logistics and deterrence.

Washington’s answer is alliance leverage.

Japan and South Korea, once fierce competitors in global shipbuilding, are now

being asked to serve as extensions of U.S. industrial power. The logic has been

institutionalized through the U.S.–Japan Memorandum of Understanding on

Shipbuilding Capacity Enhancement and a permanent bilateral working group[13] to coordinate yard modernization,

workforce development, the application of AI and robotics, and design

commonality to standardize output.

A pragmatic division of labor is emerging.

Japan will expand maintenance, repair, and overhaul (MRO) for forward-deployed

U.S. vessels in the Indo-Pacific, leveraging its infrastructure and quality

systems; the rationale and urgency for doing so were stated plainly by the U.S.

Navy Secretary, who also identified West Coast yards as natural candidates for

joint ventures with Japanese partners and emphasized the value of dual-use

commercial designs[14] that

support logistics in periods of crisis. The United States, for its part, will

integrate Japanese process engineering and project-management discipline into

domestic yards through modular block construction and outfitting.

Domestically, Tokyo is reinforcing the

foundation of next-gen shipyards. The government has set a 2035 plan to double

national shipbuilding output to 18 million gross tons; policymakers have

discussed a ¥1 trillion modernization fund[15];

and industry has committed ¥350 billion in private capex targeted at heavy-lift

cranes, digital work instructions, robotics, and workforce pipelines. A

re-entry[16] into LNG carrier construction—long a

symbol of Japanese technological leadership—aligns commercial logic with allied

energy security and gives the agenda a flagship program.

In effect, Japanese MRO abroad and U.S.

modular production at home are becoming two tiers of a single architecture: an

alliance-driven maritime ecosystem capable of co-producing capacity faster than

any single nation could achieve.

IV. Policy Convergence — FDI as Economic

Statecraft

Trump 2.0 has turned tariffs into

instruments of diplomacy. In August 2025, the European Union and the United

States announced a reciprocal trade framework under which the EU intends to

procure U.S. energy with an expected offtake valued at $750 billion through

2028[17][18][19], converting friction into

interdependence and signaling how market access can be exchanged for long-dated

offtake. The figure appears in the White House fact sheet and is reflected in

the EU’s own joint statement and a Congressional Research Service brief.

For Japan, the operative logic of tariff

diplomacy is simple: predictability is bought with pre-investment. The

Tariff-for-FDI formula—offering capital, technology, and jobs in exchange for

tariff relief and expedited review—anchors a pragmatic alliance strategy. To

make that strategy durable without overstating current law, the near-term task

is to align what already exists and to propose what should be institutionalized

next. On Tokyo’s side, policy finance is available: JBIC and NEXI can back

U.S.-sited projects in semiconductors and shipbuilding. What remains a

proposal—rather than a merger of legal regimes—is to design FEFTA screening to

be operationally interoperable with U.S. review, harmonizing documentation,

aligning administrative timelines, and designating points of contact.

On Washington’s side, a fast-track concept

for allied investors has been publicly announced: Treasury’s plan for a CFIUS

“known-investor” fast track should be fully implemented so that predictability

becomes tangible in practice; by contrast, sector-specific tariff carve-outs

for allied FDI remain a recommendation rather than an existing universal rule

and would need to be codified by regulation or legislation to translate

political trust into contractual certainty. The objective, on both sides, is a

shared economic perimeter defined less by price and more by political

trust—where FDI is not a private transaction but a collective commitment to

sustain the alliance’s material base.

V. Conclusion — From Managed Security to

Co-Produced Security

Trump 2.0 confirms a global inflection

point. The era of globalization by efficiency has yielded to globalization by

allegiance. The United States now rewards production that is physically and

symbolically inside its perimeter and disciplines what remains outside.

Japan’s answer must be entrepreneurial. In

semiconductors, it should deepen its upstream mastery while embedding R&D

within the U.S. innovation network. In shipbuilding, it should fuse domestic

modernization with U.S. yard revitalization to create a continuous production

loop across the Pacific.

The task ahead is not to draft new project

plans; it is to institutionalize predictability—to turn ad-hoc cooperation into

an enduring production architecture. When foreign direct investment becomes the

connective tissue of an alliance, it ceases to be capital. It becomes

commitment. At that moment, tariffs will no longer define borders; they will

delineate a shared factory floor. Within that space—where technology, trust,

and territory converge—Japan and the United States will not simply manage

economic security. They will co-produce it.

[1] Reuters, “US

Immigration and Customs Enforcement raids Hyundai supplier in Georgia; hundreds

detained,” September 6, 2025.

[2] Reuters, “LGES

executive is optimistic the battery maker will avoid future ICE raids,”

September 16, 2025.

[5] National

Institute of Standards and Technology (U.S. Department of Commerce),

“Biden-Harris Administration Announces CHIPS Incentives Award to TSMC Arizona,”

November 2024.

[6] U.S. Department

of Commerce, “Biden-Harris Administration Announces Preliminary Terms with

Samsung Electronics to Onshore Semiconductor Manufacturing to Texas (up to $6.4

B CHIPS incentives),” April 15, 2024.

[7] U.S. Department

of Commerce, “Biden-Harris Administration Announces up to $8.5 B in Direct

Funding for Intel Corporation to Expand Domestic Semiconductor Production

(Arizona, New Mexico, Ohio),” March 20, 2024.

[8] Office of the

Governor of New York, “Governor Hochul Announces $10 Billion Partnership to

Bring Next-Generation Research and High-NA EUV to New York,” October 2023.

[9] IBM Newsroom,

“IBM and Rapidus Form Strategic Partnership to Build Advanced Semiconductor

Technology and Ecosystem in Japan,” December 12, 2022.

[10] IBM Newsroom,

“Rapidus and IBM Expand Collaboration to Advance Chiplet Packaging for 2 nm

Generation,” June 3, 2024.

[11] Nikkei,

“U.S.–Japan shipbuilding cooperation; U.S. share near 0.2% of global output,”

October 28, 2025.

[13] Nikkei,

“U.S.–Japan sign shipbuilding MoU; permanent working group established,”

October 26, 2025.

[14] Nikkei,

“Interview with U.S. Navy Secretary (Japan-based MRO, West Coast JV, dual-use

logic),” April 28, 2025.

[15] Nikkei, “Japan to

double shipbuilding output to 18 million GT by 2035; ¥1 trillion fund under

discussion; industry plans ¥350 billion in private capex; LNG carrier re-entry

under consideration,” October 23, 2025.

[16] Nikkei, “Japan’s

domestic enablers for shipbuilding (fund and capacity measures, LNG carrier

re-entry),” October 28, 2025.

[17] The White House,

“Fact Sheet: The United States and European Union Reach Massive Trade Deal,”

July 28, 2025.

[18] European

Commission, “Joint Statement on a United States–European Union framework on an

agreement on reciprocal, fair and balanced trade,” August 21, 2025.

[19] Congressional

Research Service, “U.S.–EU Tariffs and Trade Framework Agreement,” IF13107,

September 18, 2025.

Daisuke Kawai is a Project Assistant Professor and the Director of the Economic Security & Policy Innovation Program (ESPI) at the Research Center for Advanced Science and Technology (RCAST), The University of Tokyo. His areas of expertise include Indo-Pacific security, and economic security, with a special interest in critical and emerging technologies (CETs). He also holds several senior appointments in Japan and the United States, including serving as Special Advisor to the Suntory Holdings Limited; Special Advisor to the Chairman at the Japan Association of Corporate Executives (Keizai Doyukai) in Tokyo, as well as Senior Fellow at the Center for International Private Enterprise (CIPE) of the U.S. Chamber of Commerce; Adjunct Senior Fellow at the Center for a New American Security (CNAS); and Nonresident Fellow at the National Bureau of Asian Research (NBR) in Washington, D.C.